How will GST affect Real Estate sector??

The aim of the introduction of the Goods and Services Tax (GST) is that the conclusion of multiple taxation regime.

The Indian realty sector is calculable to account for regarding five-hitter of the country’s Gross Domestic Product (GDP) and is taken into account the second-largest leader within the country.

After holding a webinar with accountant Manas Joshi, Director, Proficient Partners Consultants Pvt Ltd, we came to the conclusion of seven ways that during which the new tax regime can have an effect on the property market.

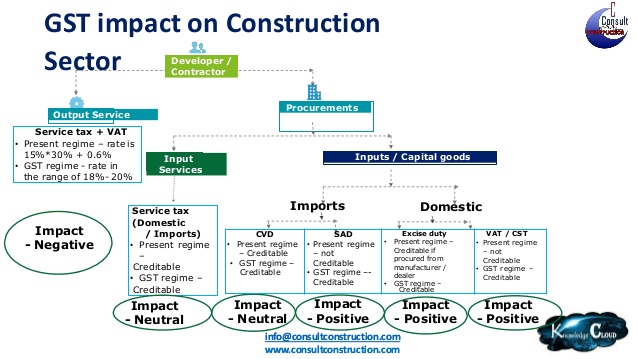

* The important real estate sector is meant to pay service tax, sales tax, excise and revenue enhancement. Of these taxes can subsume into GST, apart from revenue enhancement. So, this sector is thought of associate exception as way as GST worries as a result of this can be the sole sector wherever someone can still ought to pay revenue enhancement and capital levy, that area unit state levies.

* With the approaching of GST, the price of low or medium-cost comes can decrease upto five-hitter, since developers would be during a position to assert the input step-down.

* The decrease in costs wouldn't happen directly once the approaching of GST. It would take another nine to ten months for things to relax.

* If somebody intends to shop for a property these days, his call shouldn't get full of GST. With the approaching of GST the reduction in worth won't be quite five-hitter.

* GST might not have any effect on the Pradhan MantriAwasYojana(PMAY) and therefore the connected Credit-Linked grant theme (CLSS) for EWS, low and middle section housing. Though the govt. is predicted to stay PMAY out of the compass of GST, a proper notification during this regard from the govt. remains expected.

* Just in case of luxury properties, the costs can swell by 5-7% looking on project to project basis.

* If a builder is getting product or services from a 3rd party, he will claim credit only the third party i.e., the provider is payingGST to the govt.. This means that the govt. is pushing the important estate trade to adopt formal channels of trade instead of informal ones. The formal channels themselves are going to be creating their GST payments that the developer would get the input step-down.

For more details contact https://goo.gl/HSo4Ck

Comments

Post a Comment

Leave your comments, we are listening !!!